ZATCA-Approved E-Invoicing software for Saudi Arabia

The Zakat, Tax, and Customs Authority (ZATCA) of Saudi Arabia has mandated e-invoicing to ensure transparency, streamline tax collection, and digitize business operations. Complying with ZATCA e-invoicing requirements is not only essential for legal adherence but also a step toward operational excellence. Businesses across the Kingdom must adopt ZATCA-approved e-invoicing software to remain compliant while benefiting from streamlined financial processes.

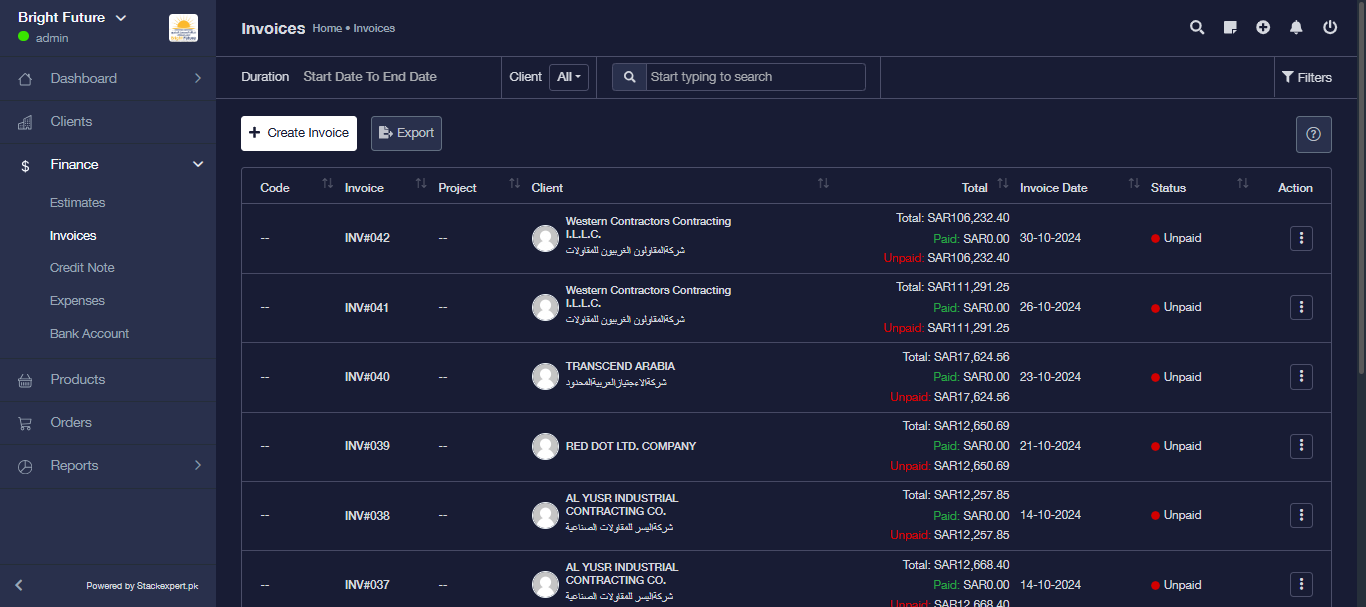

At StackExpert, we offer a robust, user-friendly, and compliance-focused ZATCA e-invoicing software in Saudi Arabia. Our solution is tailored to meet the unique needs of businesses, whether they operate on a small scale or manage large, complex operations. Let’s explore how our e-invoicing software for Saudi Arabia ensures seamless compliance with ZATCA phase 2 requirements.

How It Works? for your company

- Manage Products & Clients

- Create Invoice

- Select Products

- Select Layout

- Save/ Print

- Simple huh?

- Invoice created

What is ZATCA e-Invoicing?

The Concept Behind e-Invoicing ZATCA

E-invoicing under ZATCA involves digitizing the process of invoice generation and submission. Businesses are required to produce invoices in XML or PDF/A-3 formats, embedding a ZATCA e-invoicing QR code for verification. This system ensures the integrity and authenticity of invoices while simplifying audits and reporting.

Phases of ZATCA e-Invoicing

Phase 1 – Generation Phase

Implemented in December 2021, this phase mandated the generation of e-invoices that meet specific formatting standards.

Phase 2 – Integration Phase

Effective January 2023, Phase 2 requires businesses to integrate their systems with ZATCA’s platform for real-time invoice sharing and validation. This step, known as the ZATCA integration phase 2, enhances transparency and efficiency.

ZATCA Compliance and Penalties

Non-compliance with ZATCA regulations can lead to fines, operational disruptions, and reputational risks. Businesses must ensure they use ZATCA-compliant e-invoicing software like StackExpert to avoid penalties and stay ahead of the regulatory curve.

Features of StackExpert’s ZATCA E-Invoicing Software

Seamless Integration with ERP Systems

Our e-invoicing solutions integrate seamlessly with popular ERP platforms like SAP, Oracle, and Microsoft Dynamics. Whether you're managing complex financial workflows or handling multiple billing channels, our software ensures smooth operations and data synchronization.

Customizable Invoice Templates

StackExpert’s e-invoicing software in Saudi Arabia allows businesses to create customized invoices that align with their branding. Modify text, add logos, and adjust colors while complying with ZATCA invoice format requirements.

Automated Compliance Checks

Our software performs automated validations to ensure every invoice meets ZATCA e-invoicing phase 2 standards. From checking XML structure to verifying the inclusion of the ZATCA e-invoicing QR code, we eliminate errors before they occur.

Real-Time Reporting and Analytics

Gain valuable insights into your financial operations with advanced reporting tools. Generate reports on VAT returns, revenue, and expense tracking to make informed decisions and simplify tax submissions.

Multi-User Access and Role-Based Permissions

Assign roles and permissions to different team members, ensuring secure and efficient collaboration. This feature makes it easy for larger businesses to manage invoicing operations across departments.

24/7 Customer Support

Our dedicated support team is available round-the-clock to address any technical issues or queries. Whether you need assistance with setup or troubleshooting, we’re here to help.

Industry Applications of E-Invoicing in Saudi Arabia

E-Invoicing for Retail Businesses

- Retailers benefit from streamlined billing processes and enhanced customer satisfaction. Real-time invoice validation ensures compliance while maintaining a smooth checkout experience.

E-Invoicing for Manufacturing

- Manufacturers use e-invoicing to manage bulk transactions with suppliers and clients. Automation reduces manual errors, while data synchronization optimizes supply chain operations.

E-Invoicing for Healthcare Providers

- In the healthcare sector, e-invoicing ensures accurate billing for services and compliance with regulatory standards. It also improves operational transparency between hospitals and insurance companies.

E-Invoicing for International Trade

Simplifying Cross-Border Transactions

- E-invoicing facilitates seamless invoicing between international trading partners. Standardized formats and digital processing eliminate delays caused by inconsistent documentation.

Compliance with Global Tax Standards

- Many countries are adopting e-invoicing regulations, making it crucial for businesses to ensure compliance across borders. E-invoicing software can adapt to varying global standards.

Currency and Language Customization

- Advanced e-invoicing tools allow businesses to create invoices in multiple currencies and languages, ensuring clear communication and smooth financial exchanges with international partners.

Benefits of Using StackExpert’s ZATCA E-Invoicing Software

Compliance with ZATCA E-Invoicing Requirements

Stay compliant with ZATCA phase 2 requirements effortlessly. Our software is designed to meet all regulatory standards, ensuring your business avoids fines and maintains operational continuity.

Improved Financial Accuracy

Manual invoicing is prone to errors that can lead to compliance issues. StackExpert’s solution automates calculations and validations, minimizing errors and ensuring accuracy in every invoice.

Enhanced Operational Efficiency

Automating the invoice generation and submission process can save time and resources. Features like bulk invoice uploads and real-time validation allow your team to focus on more strategic tasks.

Scalability for Growing Businesses

Whether you're a small business or a large corporation, our e-invoicing solutions are designed to scale with your needs. Add users, expand functionalities, and handle increased transaction volumes seamlessly.

How E-Invoicing Benefits Small and Medium Enterprises (SMEs)

Affordable Compliance Solutions

SMEs can leverage cost-effective e-invoicing software tailored to their scale of operations. These solutions provide compliance and efficiency without burdening budgets.

Building Credibility with Customers

Using ZATCA-compliant e-invoicing demonstrates professionalism and transparency, enhancing customer trust and long-term business relationships for SMEs.

Access to Financial Insights

Advanced reporting tools included in e-invoicing software allow SMEs to analyze their revenue patterns, identify growth opportunities, and make informed financial decisions.

How StackExpert Simplifies ZATCA Integration Phase 2?

Understanding ZATCA Phase 2 Integration

Phase 2 of ZATCA’s e-invoicing mandates requires businesses to integrate their invoicing systems directly with ZATCA’s platform. This integration involves real-time data sharing and validation, ensuring compliance with ZATCA e-invoicing QR code and other technical standards.

Steps to Achieve ZATCA Phase 2 Compliance

Assessment and Planning

Training and Support

System Configuration

Testing and Validation

How to Train Your Team for E-Invoicing Success

Creating a Training Plan

Develop a comprehensive training plan that includes workshops, hands-on sessions, and access to digital resources. Tailor the program to meet the needs of employees in different departments.

Onboarding a Test Environment

Introduce your team to a sandbox or test environment where they can practice using the e-invoicing software without affecting live transactions. This reduces errors during the actual implementation.

Continuous Support and Updates

Provide ongoing support through regular training sessions and updates. Keeping your team informed about new features and compliance updates ensures long-term success.

The Importance of E-Invoicing in Saudi Arabia

Aligning with Vision 2030

Saudi Arabia’s Vision 2030 emphasizes digital transformation across all sectors. E-invoicing solutions play a vital role in this initiative, helping businesses adopt modern, efficient, and transparent financial practices.

Reducing Tax Evasion

By standardizing invoicing practices, ZATCA e-invoicing software helps combat tax evasion and enhances the Kingdom’s revenue collection capabilities.

Streamlining Business Operations

Adopting e-invoicing software simplifies workflows, reduces manual effort, and ensures faster invoice processing, ultimately boosting productivity.

The Future of E-Invoicing in Saudi Arabia

As technology advances, e-invoicing is poised to play an even greater role in Saudi Arabia’s digital economy. Future updates may include the integration of artificial intelligence for fraud detection, blockchain for enhanced security, and predictive analytics to optimize financial processes. Businesses adopting these innovations early will gain a competitive edge in the market.

Role of E-Invoicing in Financial Transformation

Enhancing Cash Flow Management

E-invoicing accelerates payment cycles by automating invoice generation and validation. Faster processing reduces payment delays, improving cash flow and financial stability for businesses.

Transparency in Financial Transactions

Digitizing invoices ensures that all financial records are traceable and tamper-proof. This transparency enhances trust between businesses, clients, and tax authorities, fostering sustainable partnerships.

Cost Savings through Automation

Manual invoicing involves significant administrative costs. Automating these processes reduces human effort and paper usage, contributing to long-term cost efficiency.

Key Trends in E-Invoicing Technology

AI-Powered

Analytics

- Artificial intelligence is transforming e-invoicing by providing detailed insights into spending patterns, forecasting financial trends, and automating compliance checks.

Blockchain for Invoice Security

- Blockchain technology offers tamper-proof digital ledgers, ensuring invoice authenticity and reducing fraud. This innovation is expected to revolutionize secure financial transactions.

Mobile

Accessibility

- Mobile-friendly e-invoicing solutions enable businesses to manage invoices on the go, offering flexibility and real-time updates regardless of location.

Understanding the Legal Framework for E-Invoicing

ZATCA’s Role in Tax Compliance

ZATCA enforces tax regulations to promote transparency and accountability. Understanding their guidelines ensures businesses meet all legal requirements and avoid penalties.

Importance of Tax Audit Readiness

E-invoicing simplifies tax audits by providing an accurate, digital trail of all transactions. Businesses can quickly retrieve and validate data to comply with audits seamlessly.

Penalties for Non-Compliance

Failing to adhere to ZATCA’s regulations can result in hefty fines and operational disruptions. Staying updated with the latest rules and implementing compliant software protects your business.

Preparing Your Business for ZATCA Audits

Maintaining Accurate Records

Implementing Internal Audit Processes

Leveraging E-Invoicing Tools

Choosing the Right E-Invoicing Software for Saudi Arabia

When selecting an e-invoicing software in Saudi Arabia, consider the following:

Compliance

Integration

Support

Scalability

Common Challenges in E-Invoicing Adoption

Technical Integration Issues

Integrating e-invoicing software with existing systems can be complex, especially for businesses relying on legacy ERP systems. Choosing software with strong API support and technical assistance minimizes these challenges.

Resistance to Change

Many organizations face internal resistance when shifting from manual processes to digital systems. Providing training and highlighting the long-term benefits of automation can help overcome these barriers.

Data Security Concerns

Handling sensitive financial data raises concerns about cybersecurity. Ensuring that your e-invoicing software complies with global data security standards and uses robust encryption methods can mitigate risks.

Comparing Manual and Digital Invoicing Systems

Time Efficiency

Manual invoicing is time-intensive, requiring data entry and validation at multiple stages. In contrast, digital invoicing automates these tasks, saving time and reducing errors.

Error Reduction

Human errors in manual invoicing can lead to compliance issues. E-invoicing software minimizes errors through automated validations, ensuring accurate and compliant invoices.

Data Accessibility

Digital invoicing systems store data in centralized locations, enabling quick access to financial records. Manual systems lack this advantage, making audits and reporting more challenging.

Conclusion

Complying with ZATCA’s e-invoicing mandates is not just a legal necessity but also an opportunity to enhance operational efficiency and financial transparency. StackExpert’s ZATCA-approved e-invoicing software is the ideal solution for businesses looking to stay compliant while reaping the benefits of digitized invoicing. With advanced features, seamless ERP integration, and 24/7 support, our software ensures a hassle-free e-invoicing experience. Contact StackExpert today to learn more about how our e-invoicing solutions can transform your business.

Technologies We Use

Frequently Asked Questions

About ZATCA E-Invoicing

ZATCA e-invoicing refers to the digital generation, submission, and validation of invoices in compliance with ZATCA’s regulations. It ensures transparency and accuracy in financial transactions.

A ZATCA invoice sample includes mandatory elements like the buyer and seller’s details, invoice amount, VAT, and a QR code for validation.

Phase 2 requires real-time integration of invoicing systems with ZATCA’s platform, the generation of XML invoices, and compliance with data-sharing protocols.

ZATCA e-invoicing compliance is mandatory for all VAT-registered businesses in Saudi Arabia, regardless of their size or industry, to ensure uniformity and transparency in financial transactions.

Yes, businesses that fail to comply with ZATCA e-invoicing regulations may face penalties such as fines or legal actions. It’s crucial to adhere to the rules to avoid disruptions.

Transitioning involves choosing a compliant e-invoicing solution, integrating it with existing systems, and training staff on the new processes to ensure a smooth adaptation.

A ZATCA-compliant invoice must include buyer and seller details, VAT registration numbers, invoice amount, tax amount, and a QR code for verification.

Yes, manual invoices can be digitized using e-invoicing software. However, they must meet ZATCA’s formatting and data requirements to be compliant.

Phase 1 focuses on generating e-invoices with mandatory fields, while Phase 2 involves integrating systems with ZATCA’s platform for real-time data sharing and validation.

ZATCA mandates that e-invoices be stored securely for a minimum of six years to ensure they are accessible for audits or reviews.

Yes, cross-border transactions must also comply with ZATCA regulations, ensuring invoices are accurate, traceable, and meet international standards.

The QR code on a ZATCA invoice enables quick validation of invoice details, ensuring authenticity and compliance with tax regulations.

ZATCA offers guidelines, resources, and support to help businesses understand and implement e-invoicing systems effectively.

Yes, by automating invoicing processes, businesses can save time, reduce errors, and minimize costs associated with manual workflows.

ZATCA provides a list of approved software providers. Businesses must choose solutions that meet ZATCA’s technical requirements.

E-invoicing reduces human errors, ensures accurate VAT calculations, and simplifies the reconciliation process, resulting in precise tax submissions.

Yes, ZATCA provides a sandbox environment for businesses to test their integration and ensure compliance with Phase 2 requirements.

Businesses must use systems capable of generating invoices in XML or PDF/A-3 formats, embedding QR codes, and enabling real-time data sharing.

Yes, many user-friendly solutions are available that cater specifically to small businesses, ensuring they can comply without extensive technical knowledge.

E-invoicing is a core element of Saudi Arabia’s Vision 2030, promoting digital transformation and enhancing transparency across all business sectors.

StackExpert provides a ZATCA-compliant e-invoicing software that automates compliance checks, integrates with your existing systems, and simplifies invoicing.

Get in Touch for ZATCA E-Invoicing Solutions Today!

Sumbit your query

or contact us at